Regarding the Fixed-amount Reduction for Resident Tax for Fiscal 2024 (Reiwa 6)【令和6年度個人住民税 定額減税について】

Eligibility

○ Persons whose total income for 2023 (Reiwa 5) was 18,050,000 Yen or less

(20,000,000 or less if one's income was from employment only) and was

subject to resident tax (juuminzei). (Persons subject to only to the per-capita

levy for resident tax are not eligible.)

○ Persons residing within Japan.

Reduction Amount

○ 10,000 Yen per person for spouse and dependent relatives of the eligible individual

※ Determination of spouse and dependent relatives is based, in principle, on one's

circumstances as at 31 December, 2023 (Reiwa 5).

【Eligible Spouse】

・ Spouse whose total income for 2023 (Reiwa 5) was 480,000 Yen or less

(1,030,000 Yen or less if one's income was from employment only)

※ If the eligible individual's total income for 2023 (Reiwa 5) was more than

10,000,000 Yen (more than 11,950,000 if one's income was from employment only),

a 10,000 Yen reduction for the spouse will be applied to one's individual resident tax

for Fiscal 2025 (Reiwa 7).

【Eligible Dependent Relatives】

・ Dependent relative whose total income for 2023 (Reiwa 5) was 480,000 Yen or less

(1,030,000 Yen or less if one's income was from employment only)

Application of Reduction (for Fiscal 2024 [Reiwa 6])

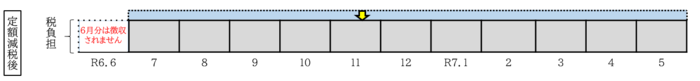

(1) Persons with income from salary (tax specially withheld from salary income)

➣ Tax for June 2024 not collected; Tax with reduction applied to be collected in 11 monthly

installments from July 2024 (Reiwa 6) through May 2025 (Reiwa 7).

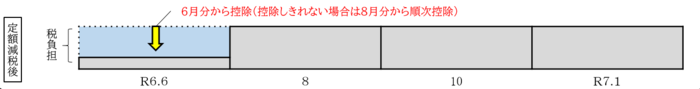

(2) Business owners (tax paid upon notification)

➣ Reduction applied from first installment (June 2024 [Reiwa 6]),and, if applicable,

will be applied to second installment (August 2024 [Reiwa 6]) and onwards.

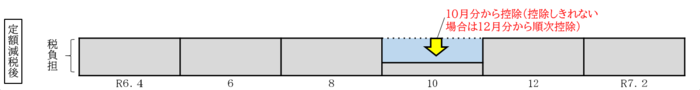

(3) Pension recipients (tax specially withheld as income related to public pensions, etc.)

➣ Reduction applied to tax specially withheld from October 2024 (Reiwa 6) installment,

and, if applicable, will be applied to tax specially withheld from December 2024 (Reiwa 6)

and onward.

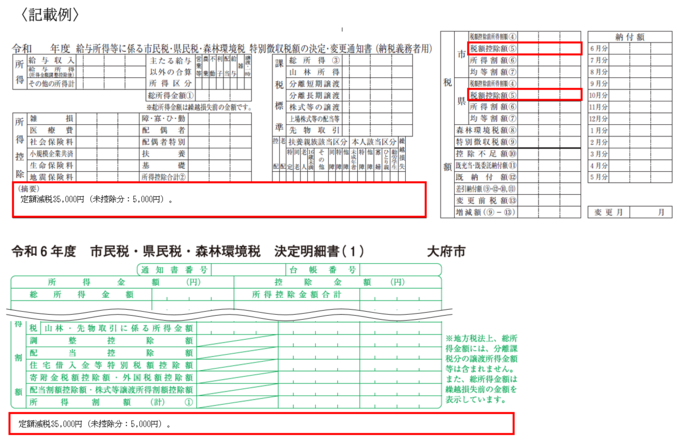

How to Confirm the Reduction Amount

The amount of one's reduction is indicated on the Notice of Tax to be Specially Withheld

(tokubetsu choushuu zeigaku tsuuchisho) or Statement of Confirmation (kettei meisaisho)

on the Notification of Tax Payable (nouzei tsuchisho).

○ The fixed-amount reduction is applied the amount of tax after all deductions,

such as for home loans, donations, etc.

Payment for persons for whom the fixed-amount tax reduction amount exceeds the income tax amount, etc.

○ In cases where the amount of the fixed-amount tax reduction is greater than the amount

of income tax for 2024 and individual resident tax for 2024, and as a result the fixed-

amount taxreduction cannot be applied in full, the remaining amount will be provided as

a payment.

Other information

For details on fixed-amount reduction for (national) income tax, please refer to the Fixed-Amount Reduction special website on the National Tax Agency website.

2024 (Reiwa 6) Fixed-Amount Reduction for Individual Resident Tax leaflet

PDFファイルをご覧いただくには、「Adobe(R) Reader(R)」が必要です。お持ちでない方はアドビシステムズ社のサイト(新しいウィンドウ)からダウンロード(無料)してください。

このページに関するお問い合わせ

市民協働部 文化交流課

文化振興係・多文化交流係 電話:0562-45-6266

ファクス:0562-47-7320

市民協働部 文化交流課へのお問い合わせは専用フォームをご利用ください。